The market for luxury real estate in LA’s Platinum Triangle has never been hotter, with prices up by 40% compared to before the pandemic, as people flock back to the buzz of the city.

In 2021, there were 229 sales in Bel-Air and Holmby Hills, most of which were single-family residences, and 359 sales in Beverly Hills. Across the two neighborhoods, sale numbers were 64% higher than in 2020 and 48% higher than in 2019.

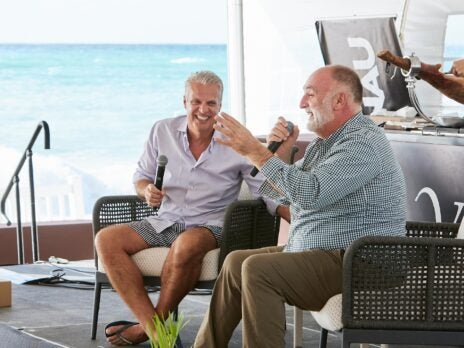

“I’ve never seen the market like this before,” says James Harris, principal at The Agency LA, also known for the Bravo show Million Dollar Listing. “Hot is an understatement – the market is on fire.”

Harris says this comes from pent-up demand and the changing lifestyle choices prompted by the pandemic. This is coming both internationally, particularly from Europe and the Middle East, but also from domestic buyers, such as tech entrepreneurs moving down from Northern California, looking for the sunshine and LA lifestyle as the world gets back to normal.

“There are new restaurants, there are new clubs, there are new bars,” Harris says. “This city is buzzing.”

[See also: Pendry West Hollywood Makes Its Sunset Strip Debut]

[See also: Hotel Bel-Air Gets Ready to Celebrate 75th Anniversary]

This increased demand has combined with the low inventory seen across the US, resulting in rapid price growth. In Beverly Hills, the median sale price has increased by almost 40% compared to pre-pandemic, up to $7.85m.

And activity is increasing most at the top end: in 2021, sales of $15m or more accounted for 5% of prime ($5m+) sales in LA Country, and 0.23% of all sales. So far in 2022, sales of $15m+ have made up 16% of prime sales, and 0.4% of all sales in the county.

But this growth isn’t exactly the same across Hollywood's Platinum Triangle, as analysis of the median price per square foot shows. In Beverly Hills, the overall median price has grown more than the price per square foot, showing that buyers have been opting for larger properties.

Harris says this speaks to the more family-oriented demographic of the neighborhood, as buyers seek properties that can accommodate home working and schooling for all family members, as well as ample space for leisure.

On the other hand, price per square foot has grown faster than the overall median price in Bel-Air and Holmby Hills, as buyers seek increasingly sophisticated properties, often at the cutting edge of wellness and leisure.

“It used to just be a sauna, now there's a steam room, cold plunge and massage therapy room,” Harris says. “We've seen every amenity you can imagine from bowling alleys to shooting ranges, to nightclubs to shark tanks. Especially since Covid-19, we're seeing real boundaries get pushed on wellness.”

Palazzo di Vista Los Angeles, in Bel-Air, is listed by The Agency for $87.77m / ©Joe Bryant

This demand is up against the lowest inventory the Platinum Triangle has seen in years, with new properties on the Hollywood market often going for well above list price. Similarly, new constructions are being sold based on renderings months or even years before expected delivery.

In 2019, the average number of active units per quarter in Bel-Air/Holmby Hills was 117. In Beverly Hills, it was 154, enough for around 35 months of sales across the two neighborhoods. In 2021, quarterly active units averaged 81 in Bel-Air/Holmby Hills and 126 in Beverly Hills, enough inventory for just 17 months.

But Harris isn’t worried. He believes the low inventory just forces agents to be more creative as they source property and anticipates rising interest rates will balance out the market, with demand remaining strong.

“I think we've got a bright year ahead of us,” he says. “It's gonna be another record-breaking year for everybody in the real estate industry.”

[See also: The Five Best Restaurants in Los Angeles]